The United States has imposed a 10% tariff on goods from China; what is the impact on steel exports?

The trend of China's steel exports to the United States has been declining in recent years.

According to CCTV News, on February 1, Eastern Time, the United States announced a 10% tariff on products imported from China, to which China expressed strong dissatisfaction and resolute opposition. In response to the erroneous actions of the U.S., China will file a lawsuit with the World Trade Organization and take corresponding countermeasures to firmly safeguard its own rights and interests.

It is worth noting that in the first half of 2024, the then U.S. President Biden announced tariffs on various Chinese imports, including semiconductors, batteries, solar cells, and steel. The tariffs on steel and aluminum products will increase from 0-17% to 25%.

This additional 10% tariff means that the tariff on steel products exported from China to the United States will rise to 35%.

Since 2024, domestic steel demand has remained sluggish, making it difficult for steel production and trading enterprises to operate. In contrast, the situation for steel exports is relatively better, with strong steel exports somewhat offsetting the adverse factors in the domestic market.

According to recent statistics from the China Iron and Steel Association, in 2024, China's steel industry is facing a situation of high output, high costs, high exports, low demand, low prices, and low efficiency, referred to as the "three highs and three lows". Key enterprises surveyed by the China Iron and Steel Association achieved a total profit of 42.9 billion yuan, a year-on-year decrease of 50.3%; the average sales profit margin was 0.71%, a year-on-year decrease of 0.63 percentage points.

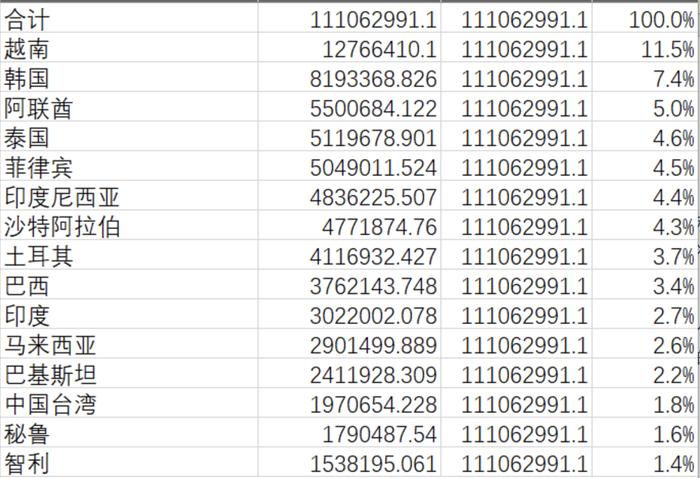

"Steel exports in 2024 are expected to grow by over 20% compared to 2023, but the proportion exported to the United States is very small, only about 0.8%. More steel products are directly exported to ASEAN and Gulf Cooperation Council countries," the trend of China's steel exports to the United States has been declining in recent years, while increasing exports to countries along the Belt and Road, South America, South Africa, and others. In 2024, China's steel products are expected to be exported the most to Vietnam, followed by South Korea and the United Arab Emirates.

Although currently only a small portion of steel products is directly exported to the United States, the impact of the tariffs on China's direct steel exports is relatively minor. However, this time tariffs have been imposed on all products exported from China to the United States, including downstream steel products such as construction machinery, household appliances, and new energy vehicles. If the export of these products is restricted due to increased tariffs, it will also affect the scale of indirect steel exports.

The impact of the tariffs on indirect steel exports is more significant, particularly on the export of downstream steel products such as home appliances and machinery. In the short term, this is reflected in reduced export profits, but more significant effects may become apparent in the second half of the year. If countermeasures continue, there will be considerable pressure to impose further tariffs on each other, and even to increase non-tariff measures, such as pressuring allies to raise tariffs or imposing anti-dumping duties on Chinese steel products, or restricting transshipment trade through third countries.