- | /

- | /

- | /

- | /

الدعم الثابت من إمدادات الأسفلت المنخفضة، يترتفع متوسط سعر الأسفلت في السوق الحالية في ديسمبر

2025-01-07 09:48

[مقدمة] على الرغم من أن الطلب على الأسفلت (3609، -13.00، -0.36%) ينخفض في ديسمبر، مع تواجد الت波动 الضيق في أسعار النفط الخام (607، -8.60، -1.40%)، فإن الدعم من ناحية التكلفة والطلب على أسعار الأسفلت في السوق الحالية محدود. ولكن نظرًا لأن معدل تشغيل مصانع الأسفلت في الشهر كان في umumية منخفضًا، لم تظهر السوق الحالية للأسفلت في ديسمبر أي علامات واضحة عن زيادة الإمدادات. والاستقرار في ناحية الإمدادات دعم قوي، مما أدى إلى ارتفاع متوسط سعر الأسفلت في السوق الحالية في الشهر.

متوسط سعر الأسفلت في ديسمبر يترتفع نسبيًا

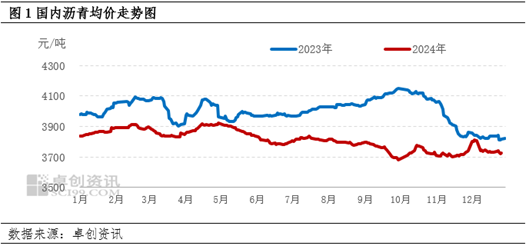

اتجاه أسعار الأسفلت في السوق الحالية خلال ديسمبر كان عبارة عن ارتفاع أولاً ثم نزول. بحلول 27 ديسمبر 2024، بلغ متوسط سعر الأسفلت في السوق الحالية في ديسمبر 3752.22 يوان/طن، أي زيادة بمقدار 36.53 يوان/طن مقارنة بالشهر السابق، což يعادل 0.98%. وكان أعلى سعر في ديسمبر هو 3811.57 يوان/طن، ظهر في 4 ديسمبر، وأخفض سعر كان 3722.29 يوان/طن، ظهر في 26 ديسمبر. من ناحية نطاق الت波动، كان نطاق الت波动 في أسعار الأسفلت في السوق الداخلية في نوفمبر 89.28 يوان/طن، وهو أكبر بشكل واضح من نطاق الت波动 في نوفمبر. بشكل عام، نظرًا لأن إمدادات الأسفلت ظلت منخفضة، ارتفع أسعار الأسفلت في السوق الحالية في بداية ديسمبر بشكل مؤقت. على الرغم من أن الطلب الثابت على الأسفلت في المناطق الشمالية توقف، وانخفض الطلب الثابت على الأسفلت في ديسمبر، وانخفضت أسعار الأسفلت في السوق الحالية بشكل مستمر، وتزايد نطاق الت波动 خلال الشهر، إلا أنها ظهرت قوة معينة نظرًا لدعم من ناحية الإمدادات. وارتفع متوسط سعر الأسفلت في الشهر نسبيًا إلى الشهر السابق.

يظل سعر النفط الخام يتداول في نطاق ضيق، وتوفر الدعم من ناحية تكلفة الأسفلت بشكل محدود

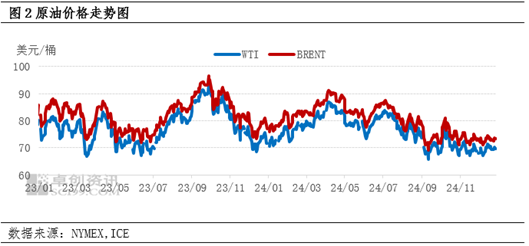

من ناحية التكلفة، بلغ متوسط سعر النفط الأمريكي في الشهر 69.46 دولارًا للبرميل، أي انخفاض بنسبة 0.11% مقارنة بالشهر السابق، وانخفاض بنسبة 3.68% مقارنةً بالعام الماضي. أما متوسط سعر برنت نفط في الشهر، فبلغ 72.92 دولارًا للبرميل، أي انخفاض بنسبة 0.66% مقارنة بالشهر السابق، وانخفاض بنسبة 5.69% مقارنةً بالعام الماضي.

في ديسمبر، كان سعر النفط يتداول في نطاق ضيق، مع عدم وجود تضارب مركزي في السوق. 一方面, كان الاحتمالات على توحيد السلام في الأوضاع في أوروبا والشرق الأوسط، مما أدى إلى تقلل تأثير الأوضاع الجيئونية على سعر النفط. ولكن استمرار السعودية وغيرها من الدول المنخفضة إنتاجها لأكثر من 3 أشهر دعم للسوق النفطية. من ناحية أخرى، فإن خطط تحفيز اقتصادي في الصين أعطت إطمئنانًا على زيادة مستمرة في الطلب على النفط. ولكن بعد خفض فيسات (Fed) للبنك المركزي الأمريكي من 25 نقطة في الأسعار، لم تغير البيانات الاقتصادية التي أُنشرت متوقع خفض الأسعار ببطء في المستقبل. وارتفع الثروة المالية بالدولار، مما أدى إلى ضغط على سعر النفط الخام. بناءً على ذلك، كان هناك موازنة بين قوة الدولار في المستوى العام والتحسن في الاقتصاد الصيني، كما كان هناك موازنة بين الأوضاع الجيئونية والدعم النفطي من السعودية في المستوى الأساسي. في بيئة من التضارب بين البيع والشراء، كان سعر النفط يتداول في نطاق ضيق.

نظرًا لأن سعر النفط الخام في الشهر كان يتداول في نطاق ضيق، انخفض متوسط سعر النفط الخام في ديسمبر نسبيًا إلى الشهر السابق. ولم يكن متوسط سعر النفط الخام في الشهر مؤشرًا واضحًا لجهد الأسفلت في السوق الحالية. ويوفر الدعم من ناحية التكلفة لجهد الأسفلت في السوق الحالية بشكل محدود.

يستمر معدل تحميل تشغيل مصانع الأسفلت في الانخفاض، بينما الدعم من ناحية الإمدادات يكون أجودًا نسبيًا

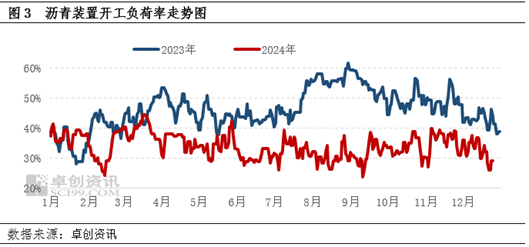

من حيث الوضع الأساسي للأسفلت، على الرغم من أن الطلب الثابت على الأسفلت في المناطق الشمالية ينخفض تدريجيًا في ديسمبر مع إيجاب الشتاء، مما يؤثر بشكل واضح وسلبيًا على أسعار الأسفلت في السوق الحالية من ناحية الطلب. ولكن نظرًا لأن تحسين أرباح إنتاج الأسفلت في ديسمبر كان قليلًا نسبيًا، وكانت أرباح إنتاج الأسفلت في المصانع الرئيسية أفضل من المصانع المحلية، فإن رغبة المصانع المحلية في إنتاج الأسفلت كانت متوسطة. وكان معدل تحميل تشغيل مصانع الأسفلت في ديسمبر 32.46% في المتوسط، أي انخفاض بمقدار 3.07 نقطة في المئوية مقارنة بالمتوسط في الشهر السابق. وانخفض إجمالي إنتاج الأسفلت بشكل واضح مقارنة بفترة نوفمبر. بالإضافة إلى أن المخزون في مصانع الأسفلت والمخزون الإجتماعي ظلوا منخفضين، ظهرت بعض الأحياء في الشهر وجود تشنج في إمدادات وتطلب الأسفلت، مما يوفر دعمًا قويًا لجهد الأسفلت في السوق الحالية. وتأخير دعم من ناحية الإمدادات، الذي كان قويًا نسبيًا، إنجح في إبطاء الانخفاض في أسعار الأسفلت في السوق الحالية إلى حد ما، وهو عامل إيجابي رئيسي لجهد الأسفلت في السوق الحالية في ديسمبر.

على المدى القصير، من ناحية الإمدادات، فإن إنتاج الأسفلت المخطط في يناير هو 1.996 مليون طن، أي انخفاض بمقدار 167 ألف طن مقارنة بالشهر السابق. بالإضافة إلى ذلك، يعد مخزون الأسفلت حالياً منخفضاً. حتى لو كان هناك زيادة في مخزون الأسفلت في يناير، فإن النسبة الزائدة ستكون محدودة. لذلك، يوجد دعم معين من ناحية الإمدادات للسوق.

ولكن من ناحية التكلفة، في يناير، سعر النفط الخام في وسط محادثة العوامل المؤثرة، لا يوجد اتجاه واضح حاليًا، ويرتفع في وضع متدابح. لذلك، الدعم الإيجابي من ناحية التكلفة لسوق الأسفلت في السوق الحالية غير كافٍ.

بالإضافة إلى ذلك، بسبب تأثير عطلة الأعياد الصينية، ربما ينخفض الطلب الثابت على الأسفلت في يناير إلى مستوى منخفض، وربما يكون التأثير السلبي من ناحية الطلب واضحًا.

التغير في إمدادات وتطلب الأسفلت الناتج عن الانخفاض الموسمي في الطلب، ربما يكون هو العامل الرئيسي المؤثر على نزول أسعار الأسفلت في المستقبل، مما يؤدي إلى انخفاض الأسعار في يناير.

كنية:

محتوى:

رمز التحقق:

إرسال التعليقات

تعليق

©2021 قالب طلاءات كيميائية للصناعة الكيميائية. جميع الحقوق محفوظة.

دعم فني:Market.Huaweiyunدخول المشرفsitemap