- | /

- | /

- | /

- | /

حالات تغير إنتاجية التهجين في عام 2023

2023-12-01 23:10

I. توزيع إنتاجية التهجين

تعداد شركات التهجين لصناعة الكوك الفولاذي في جميع أنحاء البلاد حوالي 280 شركة، وتشمل إنتاجية الكوك الفولاذي النشطة في البلاد 559 مليون طن. وتتركز بشكل رئيسي في المناطق الشمالية والشرقية للبلاد، حيث يبلغ نسبة هذه المنطقتين 63%، بينما يبلغ نسب إنتاجية التهجين في المناطق الأخرى قليلًا. خلال الفترة من 2018 إلى 2022، مع إجراء عملية استبدال إنتاجية التهجين، تم التخلص من العديد من الأثنيات الصغيرة. والغالبية من الأثنيات المستقلة كانت صغيرة، بينما ازدادت نسبة الجداول المركبة بين الصناعات الفولاذية والتهجينية بشكل تدريجي. في عام 2023،投产ت الأثنيات الكبيرة المبنية من جديد في إطار استبدال الأثنيات الصغيرة، مما أدى إلى ارتفاع نسبة إنتاجية التهجين المستقل مرة أخرى. في عام 2018، بلغت نسبة إنتاجية التهجين المستقل حوالي 65% من إنتاجية التهجين الكلية، وانخفضت نسبة إنتاجية التهجين المستقل في عام 2022 إلى 61.29%، وارتفعت في يوليو 2023 إلى 64.4%.

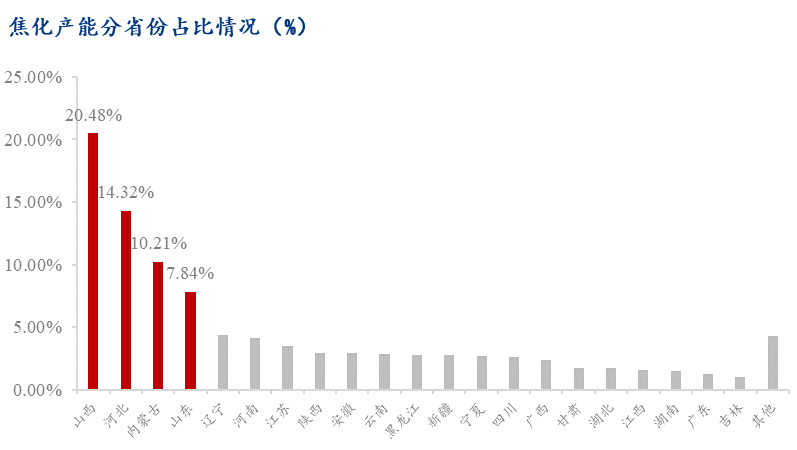

تتوزع إنتاجية الكوك الفولاذي بشكل رئيسي في مقاطعات مثل شانشي، هايبэй، إننر مونغوليا، شاندونغ، لياو نينغ وما إلى ذلك. وفي مقاطعة شانشي، تبلغ عدد شركات التهجين 63 شركة، وتبلغ إنتاجية الكوك (2604، -33.00، -1.25%) المجمعة حوالي 114 مليون طن، وتوازنها الأولى في البلاد، وتشكل 20% من إنتاجية التهجين الكلية في البلاد. أما في مقاطعة هايبэй، فتبلغ إنتاجية الكوك الفولاذي حوالي 80 مليون طن، وتشكل 14% من إنتاجية التهجين الكلية في البلاد. أما في إننر مونغوليا، فتبلغ إنتاجية الكوك الفولاذي حوالي 62 مليون طن، وتشكل 10% من إنتاجية التهجين الكلية في البلاد.

الشكل 1: نسبة إنتاجية التهجين في كل مقاطعة (وحدة: %)

مصدر البيانات: MySteel.com

II. أنواع الأثنيات التهجينية النشطة

تأسست معظم الأثنيات التقليدية في شركات التهجين في الصين بعد عام 2003 و投产ت، وتشكل حوالي 80% من الإنتاجية الكلية. خلال إطار "خطة النخبة الخامسة والعشرون"، قامت الصين بزيادة محاولات التخلص من الإنتاجية الرديئة في صناعة الكوك، حيث تم التخلص من إنتاجية 80.16 مليون طن على الصعيد الوطني (وتم التخلص بشكل كامل من الكوك الأرضي). وتم بناء 175 أثناً تقليدية جديدة، ومن بينها 166 أثناً من الأثنيات التي يتم تعبئتها من الأعلى بح Chamber إطفاء أعلى من 6 أمتار والأثنيات الم捣固 بح Chamber إطفاء أعلى من 5.5 أمتار، مع إنتاجية تبلغ 105.42 مليون طن. خلال إطار "خطة النخبة السادسة والعشرون"، قامت الصين بزيادة مجهودي التخلص من الإنتاجية الرديئة، حيث أصدرت عام 2018 "خطة إنجاز ثلاث سنوات لدفاع السماء الأزرقاء"، و أصدرت بعض المحافظات والمدن políticas لتخلص من الأثنيات بح Chamber إطفاء 4.3 أمتار. في عام 2018، تم التخلص من إنتاجية التهجين تبلغ حوالي 15 مليون طن على الصعيد الوطني، وفي عام 2019 تم التخلص من إنتاجية تبلغ حوالي 14.5 مليون طن، وفي عام 2020 تم التخلص من إنتاجية 61.546 مليون طن، حيث بلغ إجمالي إنتاجية التخلص خلال الثلاث سنوات 91.046 مليون طن.

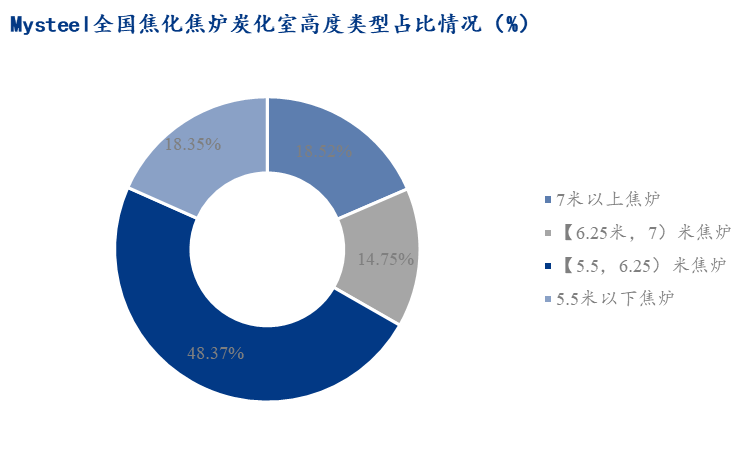

"مؤشرات التطوير في صناعة التهجين خلال إطار الخطة الخامسة والاربعون" وصفت أن شركات الأثنيات الجديدة بح Chamber إطفاء أعلى من 5.5 أمتار وشركات الأثنيات باستعادة الحرارة التي توافق مع سياسة الصناعة، يجب تسريع إجراءات تركيب نظام إطفاء الجليد الجاف. بحلول نهاية يوليو 2023، كان هناك 28 أثناً في تشغيل في الصين بح Chamber إطفاء 7.63 أمتار أو أكثر، مع إنتاجية تبلغ 28.4 مليون طن، و إنتاجية الأثنيات التي يتم تعبئتها من الأعلى بح Chamber إطفاء 7 أمتار أو أكثر تبلغ 104 مليون طن، و إنتاجية الأثنيات بح Chamber إطفاء 6.25 أمتار أو أكثر تبلغ 187 مليون طن، و إنتاجية الأثنيات بح Chamber إطفاء أقل من 5.5 أمتار تبلغ 103 مليون طن، وتشكل نسبة إنتاجية هذه الأثنيات 18.4%.

الشكل 2: نسبة أنواع الأثنيات التهجينية في الصين لعام 2023 حسب إحصاءات MySteel (وحدة: %)

مع إجراء عملية استبدال الإنتاجية، انخفضت نسبة الأثنيات الصغيرة تدريجياً. في عام 2022، انخفضت نسبة الأثنيات بح Chamber إطفاء 4.3 متر من 24% إلى 20%، وفي نهاية يوليو 2023، انخفضت نسبة الأثنيات بح Chamber إطفاء 4.3 متر بنسبة 1.6% إلى 18.4%. في العام الحالي، تم التخلص من الأثنيات بح Chamber إطفاء 4.3 متر بشكل رئيسي في شانشي. في عام 2022، تم إغلاق الأثنيات بح Chamber إطفاء 4.3 متر في شانشي والتي تضمنت إنتاجية فعالة تبلغ حوالي 19 مليون طن. ويُتوقع أن تنخفض نسبة الأثنيات بح Chamber إطفاء 4.3 متر في نهاية عام 2023 إلى 15%.

جدول 1: توزيع المحافظات الرئيسية للأثنيات بح Chamber إطفاء 4.3 متر في الصين لعام 2023 حسب إحصاءات MySteel (وحدة: مليون طن)

مصدر البيانات: MySteel.com

III. الحالات الجديدة للتكبير والتخفيض في إنتاجية التهجين لعام 2023

في 30 يونيو 2022، أعلنت مكتب الحكومة في مقاطعة شانشي "رأي بشأن دعم تطوير عالي الجودة في صناعة التهجين" (رقم قرار الحكومة في شانشي: 〔2022〕51)، حيث ذكرت أنه قبل نهاية عام 2023، ستتم إنجاز عملية إطفاء الجليد الجاف في جميع شركات التهجين في شانشي، وتكتمل جميع أعمال تحسين التفريغات لضمان أنها تقل عن الحد الأدنى، وسيتوقف جميع أثنيات بح Chamber إطفاء 4.3 متر وأي أثنيات أخرى لا تفي بالمعايير الدقيقة للتفريغات. ستتم إجراء عمليات معالجة بيئية عميقة على المشاريع الجديدة للتحديث والتطوير في صناعة التهجين والشركات التهجينية الحالية في نطاق 20 كيلومتر من منطقة بناء المدن والمناطق المحيطة بها في كل محافظة. في عام 2025، ستشهد الصناعة كاملة انخفاضًا في إجمالي استهلاك الطاقة ومعدل استهلاك الطاقة مقارنةً بعمار 2020، وسيتجاوز جميع شركات التهجين خط "التكيف"، مع محاولات تحقيق أن يصل 30% من الشركات على الأقل خط "التطوير".

في 9 نوفمبر 2022، أصدر مكتب领导小组 لتحديث وتطوير الجودة في الصناعة التهجينية في مدينة أوهاي في إننر مونغوليا "قائمة الشركات المنضبطة للتوقف والتخفيض في صناعة التهجين في مدينة أوهاي خلال الفترة 2022 - 2024". سيتم إغلاق 6 آلة من 175 فتحة مع إنتاجية إجمالية تبلغ 2.92 مليون طن قبل نهاية ديسمبر 2023، وسيتوقف 10 آلة من 294 فتحة مع إنتاجية إجمالية تبلغ 4.82 مليون طن قبل عام 2024.

في أواخر يونيو 2023، ذكرت مكتب الصناعة والتكنولوجيا في شانشي مرة أخرى أنه من أجل دعم تطوير بيئي عالي الجودة في صناعة التهجين، ستتم إغلاق جميع أثنيات بح Chamber إطفاء 4.3 متر في شانشي خلال العام الحالي، بغية تحسين كفاءة استخدام الطاقة وتوسيع السلسلة الصناعية، وتشيد قاعدة صناعة التهجين الخضراء الوطنية. وفقاً لاستطلاعات MySteel، تبلغ إنتاجية الأثنيات بح Chamber إطفاء 4.3 متر أو أقل (بما في ذلك الأثنيات باستعادة الحرارة) حوالي 103.33 مليون طن، وتبلغ إنتاجية الأثنيات بح Chamber إطفاء 5.5 متر أو أكثر حوالي 456.20 مليون طن. في العام الحالي، يتم التخلص من الأثنيات بح Chamber إطفاء 4.3 متر بشكل رئيسي في منطقة شانشي. في أواخر عام 2023، يُتوقع أن يتم التخلص من إنتاجية الأثنيات بح Chamber إطفاء 4.3 متر أو أقل في شانشي تبلغ حوالي 24.40 مليون طن.

تغيرت خطة التكبير والتخفيض في إنتاجية التهجين في شانشي. في بداية العام، كانت الخطة التخفيض من 25.86 مليون طن وتكبير 24.93 مليون طن، ولكن الآن تتوقع التخفيض من 28.56 مليون طن وتكبير 16.01 مليون طن. كما حدث تغييرات في خطة التكبير والتخفيض في إنتاجية التهجين على الصعيد الوطني. في بداية العام، كانت الخطة التخفيض من 42.60 مليون طن وتكبير 50.50 مليون طن، ولكن الآن تتوقع التخفيض من 51.68 مليون طن وتكبير 43.58 مليون طن.

جدول 2: التغيرات في التكبير والتخفيض في إنتاجية التهجين على الصعيد الوطني لعام 2023 حسب إحصاءات MySteel (وحدة: مليون طن)

مصدر البيانات: MySteel.com

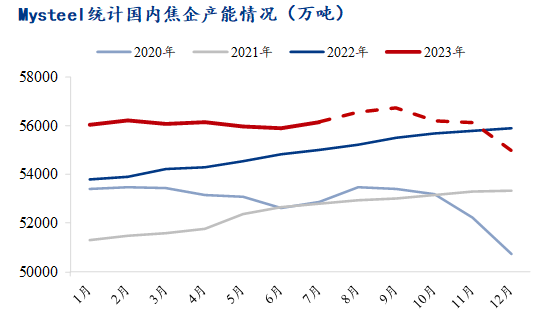

في عام 2020، وصلت عملية التخفيض الكبير في الإنتاجية إلى نهايتها. منذ عامي 2021 - 2022، ظهرت إنتاجية التهجين في حالة إضافة صافية. في عام 2023، كان هناك فائض في إنتاجية التهجين، حيث انخفضت الأسعار بشكل مستمر من يناير إلى يونيو. بعض شركات التهجين تأجّلت خطط投产ها، وتقلت الإنتاجية الجديدة المقصودة عن المقدرة في بداية العام. فضلاً عن ذلك، تعارف سياسات التخفيض في إنتاجية التهجين في مناطق شانشي وإننر مونغوليا، مما أدى إلى زيادة الإنتاجية التي يتم التخلص منها. بدلاً من الإضافة الصافية في إنتاجية التهجين المقدرة في بداية العام، تحولت إلى تخفيض صافي الآن. في بداية عام 2023، حسب استطلاعات MySteel، كان الإنتاجية الصافية الجديدة في إنتاجية التهجين تبلغ 7.9 مليون طن، ولكن في 4 أغسطس 2023، توقع إحصاءات أن يتم تخفيض إنتاجية التهجين بنسبة 8.1 مليون طن في عام 2023، مما أدى إلى تحول إنتاجية التهجين من زيادة إلى انخفاض خلال العام كله.

الشكل 3: إنتاجية شركات التهجين في الصين حسب إحصاءات MySteel (مليون طن)

مصدر البيانات: MySteel.com

IV. تغيرات في مؤشرات إنتاج شركات التهجين

بسبب متطلبات "مؤشرات التطوير في صناعة التهجين خلال إطار الخطة الخامسة والاربعون" وطلبات توسيع أحجام المنارات الفولاذية، فإن معايير إنتاج الكوك قد رفعت وارتفع الطلب على إطفاء الجليد الجاف، مما دفع إلى زيادة نسبة إطفاء الجليد الجاف ونسبة الكوك المخصص، وسيتشكل الكوك عالي الجودة رأسمالية السوق. حاليًا، تبلغ إنتاجية إطفاء الجليد الرطب في جميع أنحاء البلاد 250 مليون طن، و إنتاجية إطفاء الجليد الجاف 310 مليون طن، حيث تجاوزت نسبة إنتاجية إطفاء الجليد الجاف نسبة إطفاء الجليد الرطب. في عام 2021، بلغت نسبة إطفاء الجليد الجاف حوالي 47% من إنتاجية التهجين الكلية، بينما بلغت نسبة إطفاء الجليد الرطب 53%. بعمود تحكيم السوق والتوازن بين الإيراد والطلب وطلبات حوكمة保护环境، بلغت نسبة إطفاء الجليد الجاف في عام 2022 52.74%، وهي زيادة أعلى من 5.74% مقارنةً بالسنة السابقة. وفي نهاية يوليو 2023، بلغت نسبة إطفاء الجليد الجاف 55.27% وفقاً للإحصاءات.

مع توسيع أحجام المنارات الفولاذية الجديدة في مصانع الفولاذ، ارتفعت متطلبات قوة الكوك، وتغيرت بنية الاستهلاك. وفقاً لاستطلاعات غير كاملة من MySteel، فإن نسبة استهلاك الكوك من الدرجة شبه الأولى في المنارات الفولاذية بحجم 2000 - 3000 متر مكعب لا تزيد عن 50%، وفي المنارات بحجم 3000 متر مكعب، لا تزيد نسبة استهلاك الكوك من الدرجة شبه الأولى عن 25%. كلما ازداد حجم المنارة، زاد حجم المنارة، وقلت نسبة استهلاك الكوك ذي قوة تفاعل أقل من 60. في عام 2022، ارتفعت نسبة الكوك من الدرجة شبه الأولى أو أعلى من 70.2% إلى 76.3%. من بينها، بلغت نسبة استهلاك الكوك الفولاذي من الدرجة الأولى 32.5%، وهي زيادة بنسبة 6.9% مقارنةً بالسنة السابقة، حيث ازدادت نسبة استهلاك الكوك من الدرجة الأولى. أما نسبة الكوك من الدرجة الثانية أو أقل، فقد بلغت 19.2%، وهي انخفاض بنسبة 2.1% مقارنةً بالسنة السابقة. في المستقبل، مع استمرار التخلص من المنارات الفولاذية بحجم أقل من 1000 متر مكعب، ستواصل هذه النسبة إلى الانخفاض.

V. عملية تحسين وتحديث الإنتاجية لا تزال مستمرة

"رأي بشأن دعم تطوير عالي الجودة في صناعة التهجين" في مقاطعة شانشي، يتطلب تحقيق هدف إطفاء الجليد الجاف بشكل كامل قبل نهاية عام 2023. في شانشي، تحتاج إلى تحقيق تحسين التفريغات لضمان أنها تقل عن الحد الأدنى في جميع أثنيات إطفاء الجليد الرطب المتبقية بنسبة 56% في أقل من نصف عام، وتوقف جميع أثنيات بح Chamber إطفاء 4.3 متر بنسبة 21% وغيرها من الأثنيات التي لا تفي بالمعايير الدقيقة للتفريغات. حتى الآن، تبلغ إنتاجية الأثنيات بح Chamber إطفاء 4.3 متر في شانشي حوالي 24 مليون طن. إذا أرادت شانشي تحقيق هذا الهدف، ستواجه في نهاية العام عملية تكبير كبيرة في التخفيض في الإنتاجية.

"مؤشرات التطوير في صناعة التهجين خلال إطار الخطة الخامسة والاربعون" تشير إلى أن شركات الأثنيات الجديدة بح Chamber إطفاء 5.5 متر أو أكثر وشركات الأثنيات باستعادة الحرارة التي توافق مع سياسة الصناعة، يجب تسريع إجراءات تركيب نظام إطفاء الجليد الجاف. بحلول نهاية يوليو 2023، تبلغ إنتاجية الأثنيات بح Chamber إطفاء 4.3 متر في جميع أنحاء البلاد 103 مليون طن، وهي حوالي 18.4% من إنتاجية التهجين الكلية في البلاد. حتى لو أجرت شانشي سياسة التخلص من الأثنيات الصغيرة في نهاية العام، ما زالت هناك إنتاجية لأثنيات صغيرة أخرى في المناطق الأخرى تبلغ 8400 طن. وفقاً لمتطلبات "خطة النخبة الخامسة والاربعون"، ستتم استبدال وتخفيض الإنتاجية الرديئة تدريجياً، وتستمر عملية تحسين وتحديث إنتاجية التهجين.

كنية:

محتوى:

رمز التحقق:

إرسال التعليقات

تعليق

©2021 قالب طلاءات كيميائية للصناعة الكيميائية. جميع الحقوق محفوظة.

دعم فني:Market.Huaweiyunدخول المشرفsitemap